Kotak MNC Fund: Have you ever wondered why multinational giants like Apple, Google, and Amazon continue to thrive in a rapidly changing global landscape? While these companies may focus on distinct industries, they share a common characteristic as multinational corporations (MNCs). This blog will delve into the factors that make MNCs attractive investment choices and explore the benefits they offer to investors.

What are MNCs?

These are companies that are registered in one country, but also operate in other countries. Examples include Hindustan Unilever Ltd (India), Nestle India Ltd (India), Bosch Ltd (India).

Benefits of MNCs

For Businesses: They enjoy a wider presence, an ease in product launches, embracing strategic alliances, fostering innovation, higher ROE, etc.

For Consumers: Gain access to quality products, cutting-edge technology, affordable and reliable products, etc.

For Markets: An Increased investment, hike in job creation and technology transfer.

Why Invest in MNCs?

Strong Brand Recognition: MNCs are household names with a reputation for quality and reliability.

Global Diversification: MNC’s are less exposed to economic downturns in any single country.

Growth Potential: MNC’s tend to be leaders in their respective industries and have a strong track record of growth.

Outperformance: Historically, MNC’s have outperformed broader market indices.

Lower Risk: MNC’s tend to have lower volatility and more stable earnings than domestic companies.

Dividend Payouts: Many MNC’s have a history of paying regular dividends to shareholders.

Potential Challenges

Limited Supply: MNC’s rarely issue new shares, making them more valuable due to lower supply and high demand.

Active Management: Active management is crucial to identify MNC’s that prioritize minority shareholder interests and avoid excessive royalty payments to parent companies.

Understanding the Allure of MNCs

Multinational corporations (MNC’s) have long captivated investors with their potential for growth and stability. These global giants often possess several key advantages:

Financial Strength: MNC’s typically boast robust balance sheets and consistent profitability, making them less susceptible to market fluctuations.

Brand Recognition: Their widespread presence and strong brand recognition can provide a competitive edge and facilitate market penetration.

Technological Innovation: MNC’s often invest heavily in research and development, driving innovation and staying ahead of the curve.

Global Reach: Their international operations can diversify risk and provide exposure to multiple markets.

Government Incentives

The Indian government has implemented several measures to make India a more attractive destination for multinational companies (MNC’s). These measures include but are not limited to,

Tax incentives:

Reduced corporate tax rates: The government has reduced corporate tax rates for new manufacturing companies and for existing companies that increase their investments in India.

Tax holidays: Certain sectors, such as manufacturing and electronics, are eligible for tax holidays, which provide tax exemptions for a specified period of time.

Double taxation avoidance agreements: India has signed double taxation avoidance agreements with many countries, which help to reduce the tax burden on MNCs operating in India.

Infrastructure development:

Investment in infrastructure: The government is investing heavily in infrastructure projects, such as roads, railways, and ports, to improve connectivity and reduce logistics costs for MNCs.

Special economic zones (SEZs): SEZs are designated areas with special tax and regulatory benefits to attract foreign investment.

Ease of doing business reform:

Simplification of procedures: The government has taken steps to simplify procedures for setting up businesses and obtaining permits and approvals.

Online services: Many government services are now available online, making it easier for MNC’s to interact with government agencies.

Skill development:

Vocational training: The government is investing in vocational training programs to develop the skills of the Indian workforce.

Foreign collaborations: The government is encouraging foreign collaborations in education and training to improve the skills of the Indian workforce.

Market access

Trade agreements: India has signed trade agreements with many countries, which provide preferential market access for Indian exports.

Liberalisation of the economy: The government has been liberalising the economy, making it easier for MNCs to do business in India.

These measures have made India a more attractive destination for MNCs, and have contributed to the country’s economic growth.

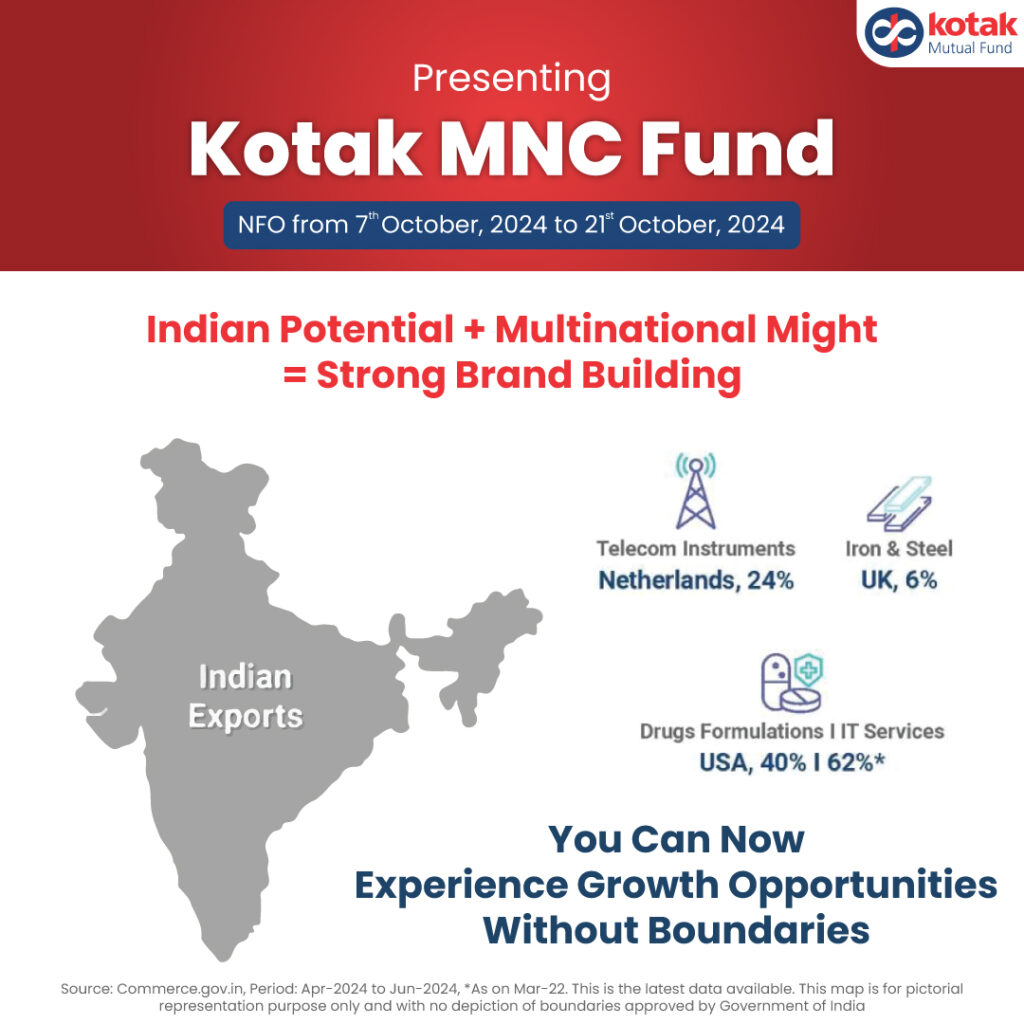

Kotak MNC Fund: A Strategic Approach

The Kotak Fund is designed to capitalise on the growth potential and stability offered by multinational companies. By investing primarily in equity and equity-related securities of MNC’s, the fund aims to generate long-term capital appreciation.

Key Features of the Fund

Focused Investment: The fund concentrates on MNC’s, providing targeted exposure to this promising theme.

Diversified Portfolio: The fund invests in a variety of MNCs across different sectors and geographies, reducing risk and enhancing returns.

Experienced Management: The fund is managed by a team of experienced investment professionals with a proven track record.Potential for Long-Term Growth: MNCs often exhibit consistent growth and can provide stable returns over the long term.

Why Invest in the Kotak MNC Fund?

Diversification: Adding the Kotak Fund to your portfolio can help diversify your investments and reduce overall risk.

Exposure to Global Markets: The fund offers exposure to a wide range of global markets, potentially capturing growth opportunities from various regions.

Potential for Outperformance: MNCs can often outperform domestic markets, providing the potential for higher returns.

Professional Management: Rely on the expertise of the fund’s management team to navigate the complexities of the global market.

The Kotak MNC Fund primarily focuses on investing in multinational companies operating in the following sectors:

Information Technology: The fund invests in IT companies that are driving digital transformation and innovation.

Consumer Staples: This includes companies that produce essential goods and services, such as food, beverages, and personal care products.

Financials: The fund invests in financial institutions, including banks, insurance companies, and asset management firms.

Healthcare: The fund invests in healthcare companies that are developing new treatments and therapies.

Industrials: This sector encompasses companies involved in manufacturing, construction, and transportation.

The fund also invests in MNCs operating in other sectors, as long as they meet the fund’s investment criteria.

Geographic Focus

The Kotak Fund invests in MNCs operating in various regions, with a particular focus on:

Developed Markets: The fund invests in established MNCs from countries such as the United States, Europe, and Japan.

Emerging Markets: The fund also invests in MNCs from emerging markets, such as China, India, and Brazil, capturing the growth potential of these regions.

By investing in a diversified portfolio of MNCs across different sectors and regions, the Kotak MNC Fund aims to generate long-term capital appreciation while managing risk.

Fund Details

- Category: Equity Schemes –Thematic Fund.

- Name Of The Scheme: Kotak MNC Fund

- Benchmark: Nifty MNC TRI (Total Return Index)

- Typical Investment Horizon: 5+ years

- Minimum Application Amount: Rs. 100 and in multiples of Rs. 1 thereafter

- Exit Load: For redemption /switch out of upto 10% of the initial investment amount (limit) purchased or switched in within 1 year from the date of allotment: Nil. If units redeemed or switched out are in excess of the limit within 1 year from the date of allotment: 1%. If units are redeemed or switched out on or after 1 year from the date of allotment: NIL

- Dates: 7 October 2024 – 21 October 2024

Investing in MNCs: Conclusion

Investing in MNCs can be a strategic choice for investors seeking growth and stability. The Kotak Fund provides a convenient and diversified way to invest in this promising theme. However, it’s important to remember that investing in equity funds involves market risk, and there’s no guarantee of future returns.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Before making any investment decisions, please consult with a qualified financial advisor.