In today’s complex financial landscape, investors are continually seeking smarter, more flexible, and more diversified ways to grow their wealth. One such powerful vehicle is the Specialized Investment Fund (SIF). Although not as widely known as mutual funds or AIFs, SIFs have carved out a strong presence, particularly among institutional and sophisticated investors. But what exactly is an SIF, and why is it gaining so much attention?

What is a Specialized Investment Fund?

A Specialized Investment Fund (SIF) is a regulated, flexible, and supervised collective investment scheme primarily designed for:

- High-net-worth individuals (HNIs)

- Institutional investors

- Professional investors

It allows for a broad investment strategy—ranging from traditional assets like equities and bonds to alternative assets such as:

- Real estate

- Private equity

- Infrastructure

- Hedge funds

Note: Derivatives can also be used for hedging, speculation, and arbitrage, with a maximum allocation of 25%.

Minimum Investment Required: ₹10 Lakhs

What Sets SIFs Apart?

- Flexible Investment Strategy

- Regulated by SEBI

- Risk Diversification

- Tax Efficiency

- Hedging, speculation, and arbitrage allowed (up to 25%)

Who Invests in SIF?

SIFs attract a diverse group of sophisticated investors, including:

- Institutional investors

- Family offices

- High-net-worth individuals

Foreign Portfolio Investors (FPIs) looking to diversify holdings in global or sector-specific markets

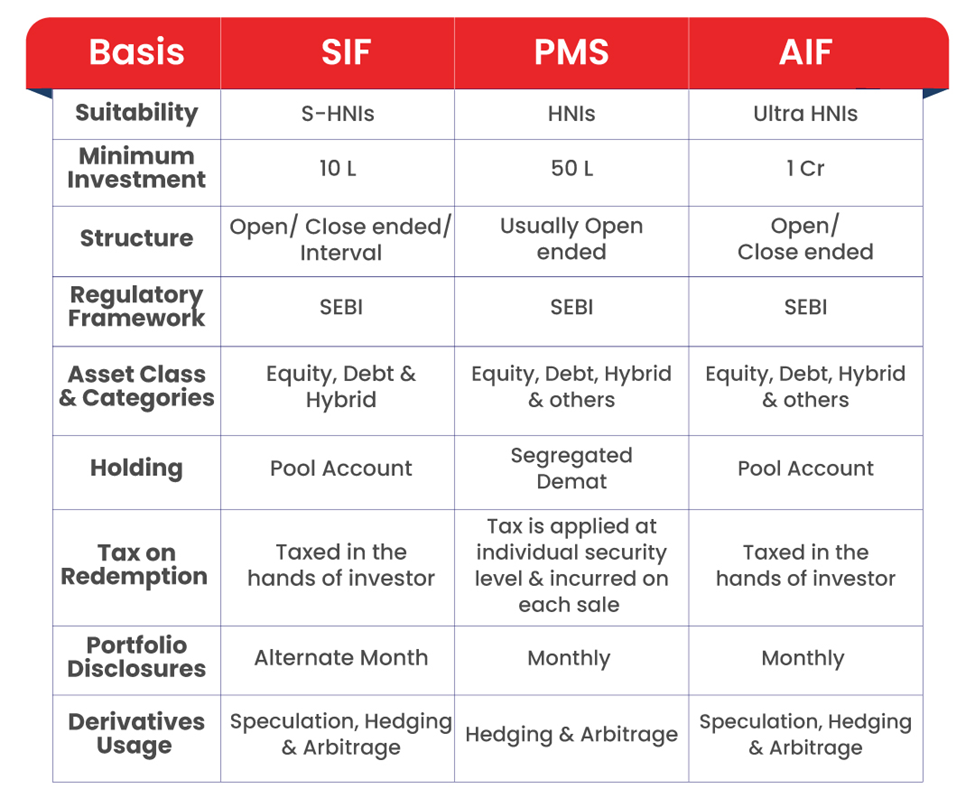

Understanding SIFs in Context: How They Compare with PMS and AIF Structures

Each investment vehicle serves a different type of investor. Here’s how SIF, PMS, and AIF compare:

This comparison shows that while Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs) have their own merits, SIFs offer a unique blend of regulatory oversight, flexibility, and diversification with a relatively low entry point of ₹10 Lakhs—making it a compelling option for smart investors.

निष्कर्ष

A Specialized Investment Fund is not just another investment vehicle—it’s a strategic, flexible solution for seasoned investors aiming to expand their portfolios beyond conventional boundaries. Its structure supports innovation, adaptability, and diversification—qualities that are crucial in a fast-evolving global market.

Whether you’re looking to complement your systematic investment plan or explore new frontiers in asset diversification, SIF investment opens doors to smart, structured, and scalable wealth creation.