India stands on the edge of a digital revolution. Over the past decade, we have seen a large-scale change in how people live, work, act and even manage their money. From smartphones and digital payments to online education and AI-operated solutions, technology is now woven in our everyday lives. And it just grows up.

Internet penetration, cheap data, a young and dynamic population and strong government support through programs such as Digital India and Startup India, and quickly turn into a global technical power plant. This rapid digitization has created a fruitful country for technology companies, such as growing, innovation and scale like never before.

If you wait at the right time to invest in this rapidly growing area, that moment may come.

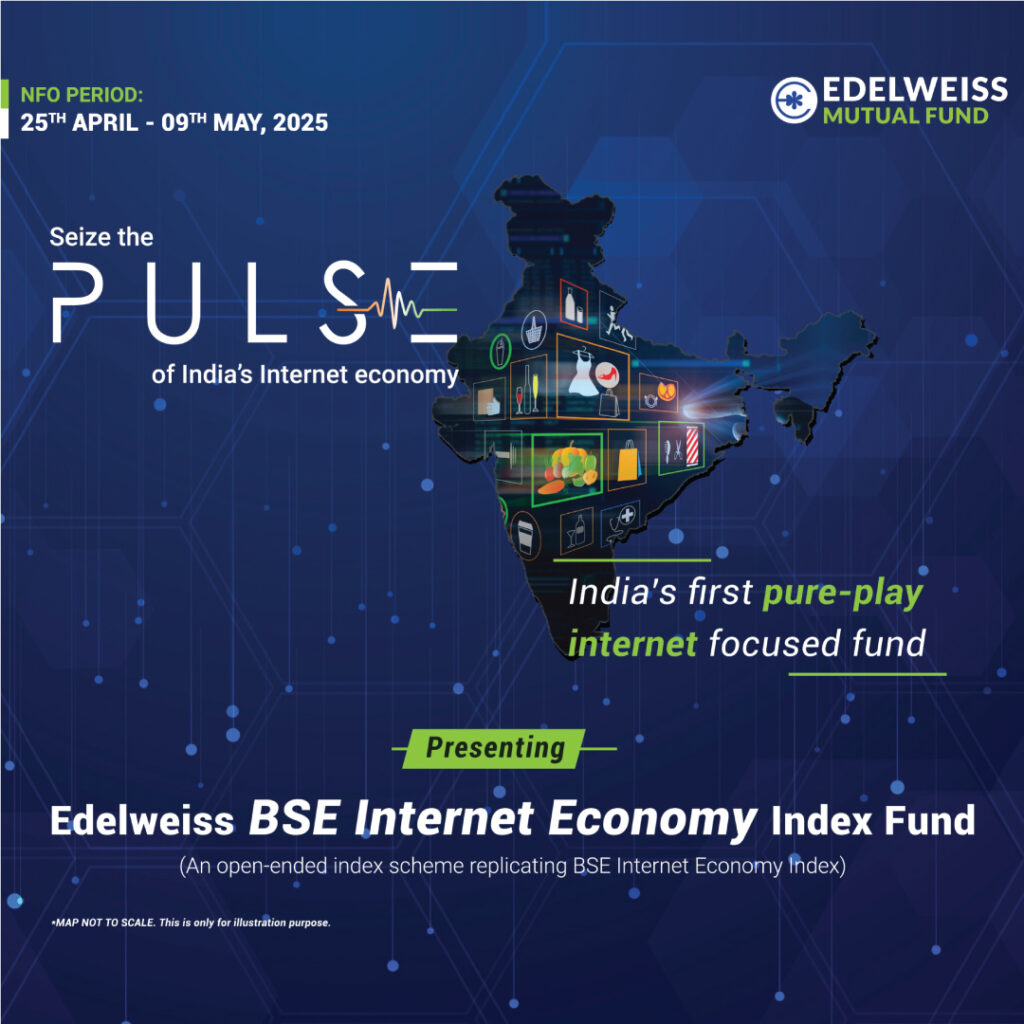

Edelweiss Asset Management has introduced a new opportunity through a new Fund offering (NFO) for investors who believe in India’s technical first future. This NFO is designed to use the capacity of companies that are moving digital changes. Whether it is IT services, fintech, mother-in-law, e-commerce or digital infrastructure purpose with this fund is to give you access to some of the most promising areas that form India’s tomorrow.

What is a New Fund Offer (NFO)? Let’s Break it Down

A New Fund Offer, or NFO, is the release of a brand-new mutual fund scheme by using an Asset Management Company (AMC) like Edelweiss. It’s the first time that the fund is made available for investment to the public. If you are acquainted with the concept of an Initial Public Offering (IPO) within the stock market, an NFO is particularly similar—however for mutual budget.

Here’s the way it works:

When an AMC makes a decision to release a new fund, they open it up for a confined subscription window—commonly some days to more than one weeks. During this period, traders can buy units of the fund at a hard and fast base fee, maximum normally ₹10 per unit. This is basically the entry fee, and it remains steady at some stage in the NFO period.

Once the NFO closes, the mutual fund becomes energetic inside the marketplace. From that factor on, its Net Asset Value (NAV) will fluctuate primarily based on the performance of the underlying investments. You can nonetheless make investments within the fund after the NFO length, but the rate will not be fixed—it’ll range daily, much like other mutual budget.

Why Do Investors Consider NFOs?

NFOs present a few unique advantages:

Early Entry at a Low Price

Since the fund units are offered at a base price, typically ₹10, investors can accumulate more units for a relatively small investment. This can be attractive for those looking to enter a promising sector at the ground level.

Access to New Themes and Strategies

Many NFOS are launched to target fresh investment ideas—sectors that are newly emerging, changing rapidly, or are not adequately covered by existing funds. This Edelweiss NFO, for example, focuses entirely on India’s tech and digital growth story—something that isn’t commonly available in traditional equity mutual funds.

Long-Term Growth Potential

Thematic NFOS, when backed by strong market trends and expert fund management, have the potential to deliver strong returns over the long term. By investing early, you position yourself to ride the growth wave from its early stages.

NFO vs Regular Mutual Funds: Is There a Difference?

A common question among first-time investors is—Why choose an NFO over an existing mutual fund?

It depends on the investment strategy. While existing mutual funds come with an established track record, NFOS offer early access to new ideas that might not yet be available in the market. Think of it like being able to buy into an exciting new business model before it becomes mainstream.With the Edelweiss Technology Fund, you’re not just investing in another equity fund—you’re aligning your money with the future of India’s digital economy. The focus is clear: invest in tech, ride the innovation wave, and potentially benefit from long-term compounding.

Why Invest in Edelweiss BSE Internet Economy Index Fund?

- First-of-its-Kind Investment Opportunity

This is one of the first index funds in India focused exclusively on the internet economy. It gives you early access to a specialised theme that many existing mutual funds don’t offer.

- Riding the Digital India and Startup Boom

With strong government support and a booming startup ecosystem, India is producing digital unicorns at a record pace. This fund positions you to benefit from that growth, without needing to pick individual winners. - Benefit from the Shift to Online

From online shopping and digital payments to virtual healthcare and ed-tech, India is rapidly moving online. This fund helps you ride the wave of this massive behavioral and structural shift. - Diversification Within the Digital Space

Rather than betting on one or two individual tech stocks, this fund gives you diversified exposure to a basket of companies driving the internet economy—reducing risk while still targeting growth. - Backed by a Trusted AMC: Edelweiss

Edelweiss Mutual Fund is known for its innovation and investor-first approach. Their fund managers bring experience, research strength, and a focus on long-term value creation. - Low-Cost Access to High-Potential Growth

As an index fund, it comes with a low expense ratio compared to actively managed funds. This means more of your money stays invested and benefits from compounding over time. - Ideal for Long-Term Wealth Creation

This fund is not about short-term gains—it’s about participating in India’s digital future. If you believe in the 5–10 year growth story of tech and digital innovation, this fund is aligned with your goals. - Perfect Addition to a Core Portfolio

If you already invest in large-cap or flexi-cap funds, adding this internet economy fund gives you thematic diversification. It complements your portfolio while targeting a new and exciting segment.

Bottom Line

An NFO is a launchpad—an opportunity to invest early in a new opportunity to invest in a new fund with a unique theme or structure. Although it is important to remember that each investment risks to some extent, a compelling proposal for investors provides a growth -minded investors that were launched by Edelvis as NFOS.

If you believe in India’s technical revolution, there may be a chance to participate in it – not just as a consumer of digital innovation, but also as an investor in many companies. As usual, it is intelligent to consult a reliable financial advisor before making any investment decision, especially with theme -based mutual funds. But for those who want to think and invest for a long time, this new fund offer may be the best NFO to invest for a technology -driven tomorrow.