Canara Robeco NFO Multi Asset Allocation Fund: A Strategic Investment Opportunity

The Canara Robeco NFO Multi Asset Allocation Fund is designed to help investors navigate market volatility through a diversified portfolio. In an era of economic uncertainty, geopolitical tensions, and fluctuating interest rates, Canara Robeco NFO multi-asset allocation have gained traction as a prudent way to balance growth and stability. This blog explores its features, benefits, and why it stands out in today’s dynamic financial landscape, offering actionable insights for investors seeking long-term wealth creation.

What is a Multi-Asset Allocation Fund?

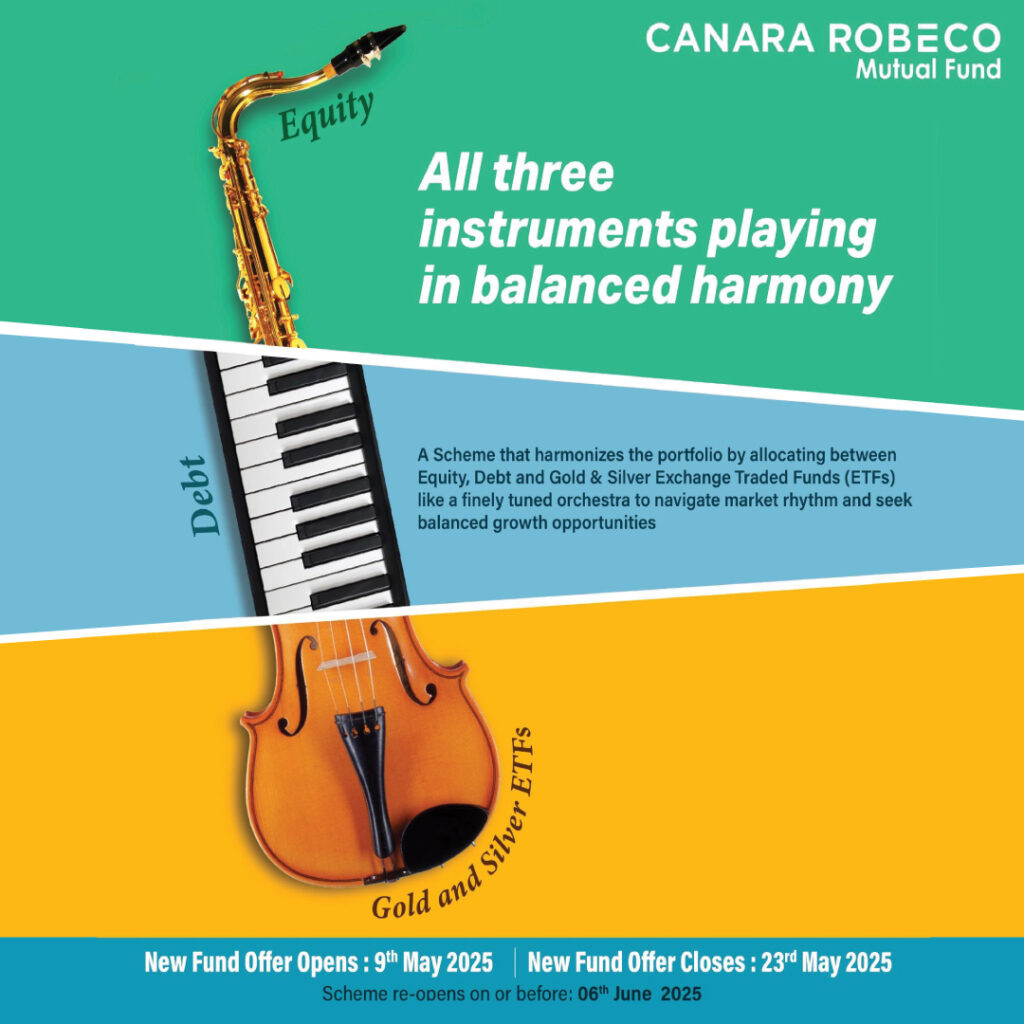

A multi-asset allocation fund invests across multiple asset classes, such as equity, debt, commodities, and ETFs. This diversification reduces risk and enhances returns by balancing exposure to different market cycles. For instance, while equities may surge during economic expansions, debt instruments provide stability during downturns, and gold acts as a haven during crises. By combining these assets, the fund aims to deliver smoother returns compared to single-asset portfolios. Modern portfolio theory underscores the importance of diversification: uncorrelated assets minimize overall portfolio risk. Canara Robeco NFO Multi-asset allocation funds take this a step further by dynamically adjusting allocations based on macroeconomic trends, valuations, and risk appetite. The Canara Robeco NFO fund, for example, leverages this approach to optimize returns while managing drawdowns.

Key Features of Canara Robeco NFO (New Fund Offer) Multi Asset Allocation Fund

Diversified Portfolio

- Equity (65-80%): The fund focuses on high-growth stocks across market capitalizations, including large-cap stability, mid-cap potential, and small-cap agility. Sectors like technology, consumer goods, and infrastructure may be prioritized based on growth cycles.

- Debt (10-25%): Stability is enhanced through high-credit-quality instruments like AAA-rated corporate bonds, government securities, and money market tools. These provide predictable income and cushion against equity volatility.

Gold & Silver ETFs (10-25%): Precious metals act as a hedge against inflation, currency depreciation, and geopolitical risks. Historically, gold has outperformed during stagflation or market crashes, making it a strategic counterbalance.

Active Management

The fund employs periodic rebalancing driven by economic indicators (GDP growth, inflation), valuations (P/E ratios, yield spreads), and risk premiums. For example, if equity valuations turn expensive, the fund may trim exposure and increase debt or gold allocations. These tactical shifts aim to capitalize on market inefficiencies.

Risk-Adjusted Returns

Historical data shows that multi-asset funds exhibit lower volatility (measured by standard deviation) than pure equity funds. For instance, during the 2008 crisis, a 60% equity/40% debt portfolio fell ~25% vs. ~50% for pure equities. The Canara Robeco NFO fund’s inclusion of gold further mitigates downside risks.

Why Choose This New Fund Offer (NFO)?

1. All-Weather Strategy: The fund is engineered to perform across bull, bear, and sideways markets. For example, equities drive growth in expansions, debt stabilizes during recessions, and gold shines in inflationary periods.

2. Expert Fund Management: Canara Robeco NFO Managed by seasoned professionals both in equities and debt markets, where the team combines macroeconomic foresight with bottom-up stock picking.

3. Tax Efficiency: Classified as an equity fund, long-term gains (held >1 year) are taxed at 10% beyond ₹1 lakh, compared to debt funds’ 20% with indexation. This enhances post-tax returns for buy-and-hold investors. This New Fund Offer is ideal for those seeking exposure to a diversified and managed solution for the creation of long-term wealth.

Investment Strategy: How It Works

Step 1: Equity Allocation

Equity exposure (65-80%) is adjusted using metrics like earnings momentum (quarterly EPS growth), market valuations (CAPE ratio), and sectoral trends. For instance, if tech stocks are overvalued, the fund may rotate into undervalued industrials or financials.

Step 2: Precious Metals Allocation

A 10-25% allocation to gold and silver ETFs hinges on yield differentials (real interest rates) and USD trends. When real yields fall, gold typically rallies, making it a tactical overweight during dovish monetary policies.

Step 3: Debt Allocation

The 10-25% debt component focuses on short-duration instruments (1-3 years) to minimize interest rate risk. Instruments like treasury bills and high-grade corporate bonds offer liquidity and stability.

5 Reasons to Invest in This Multi-Asset Allocation Fund

- Diversification: Reduces concentration risk. For example, it is observed that portfolios with 20% gold had 15% lower volatility than pure equity portfolios.

- Active Rebalancing: The fund adapts to market shifts, like increasing gold during the 2020 pandemic sell-off, to lock in gains and avoid emotional investing.

- Inflation Hedge: Gold and silver have historically outpaced inflation. From 2000–2020, gold delivered ~9% annualized returns vs. global inflation of ~3.5%.

- Lower Volatility: A balanced mix of assets smooths returns. The fund’s 12-month rolling returns may avoid extreme negatives seen in pure equity funds.

Long-Term Growth: Targets capital appreciation by capturing opportunities across cycles, such as post-recession equity rebounds or bond rallies during rate cuts.

Risks to Consider

- Market Risks: Equity downturns, rising bond yields, or stagnant gold prices could impact returns. For instance, a 2023 rate hike cycle pressured both equities and bonds.

- Moderate-High Risk: The fund’s Riskometer indicates “Very High Risk” due to equity dominance. Conservative investors may prefer hybrid funds with lower equity exposure.

- No Guaranteed Returns: Past performance (e.g., 12% CAGR in backtests) doesn’t assure future results. Market shocks like geopolitical conflicts could disrupt projections.

This New Fund Offer is best approached with a long-term mindset and guidance from a financial advisor.

Final Thoughts:

The Canara Robeco Multi Asset Allocation Fund offers a strategic blend of growth and stability. Its focus on diversification and active management could be a valuable addition to a long-term portfolio. Nivesh simplifies investing in such funds by offering curated insights, tools, and expert advice.

Disclaimer: Mutual fund investments are subject to market risks. Past performance is not indicative of future returns. Read all scheme-related documents carefully.

Frequently Asked Questions (FAQs)

Q1. What is the minimum investment amount?

A: The minimum SIP or lump-sum amount will be specified in the Scheme Information Document (SID), typically ₹500 for SIPs and ₹5,000 for lump sums.

Q2. How does this fund handle market downturns?

A: Its diversified portfolio and active rebalancing aim to minimize losses. During the 2020 COVID crash, similar funds reduced equity exposure by 10–15%, limiting declines.

Q3. Is this NFO suitable for conservative investors?

A: Due to its equity-heavy allocation, it’s better suited for investors with a 5–7-year horizon and moderate-to-high risk appetite. Conservative investors may allocate only 10–15% of their portfolio.

Q4. What is the exit load?

A: exit load applies if redeemed beyond 12% of units within 365 days. For instance, a 1% charge may apply on redemptions exceeding this limit. Check the SID for exact details.