The fund’s strategy is simple: Many people invest in the arbitration fund, bring diversity to risk, and allocate active property based on market conditions.

Key Features of This New Fund Offer

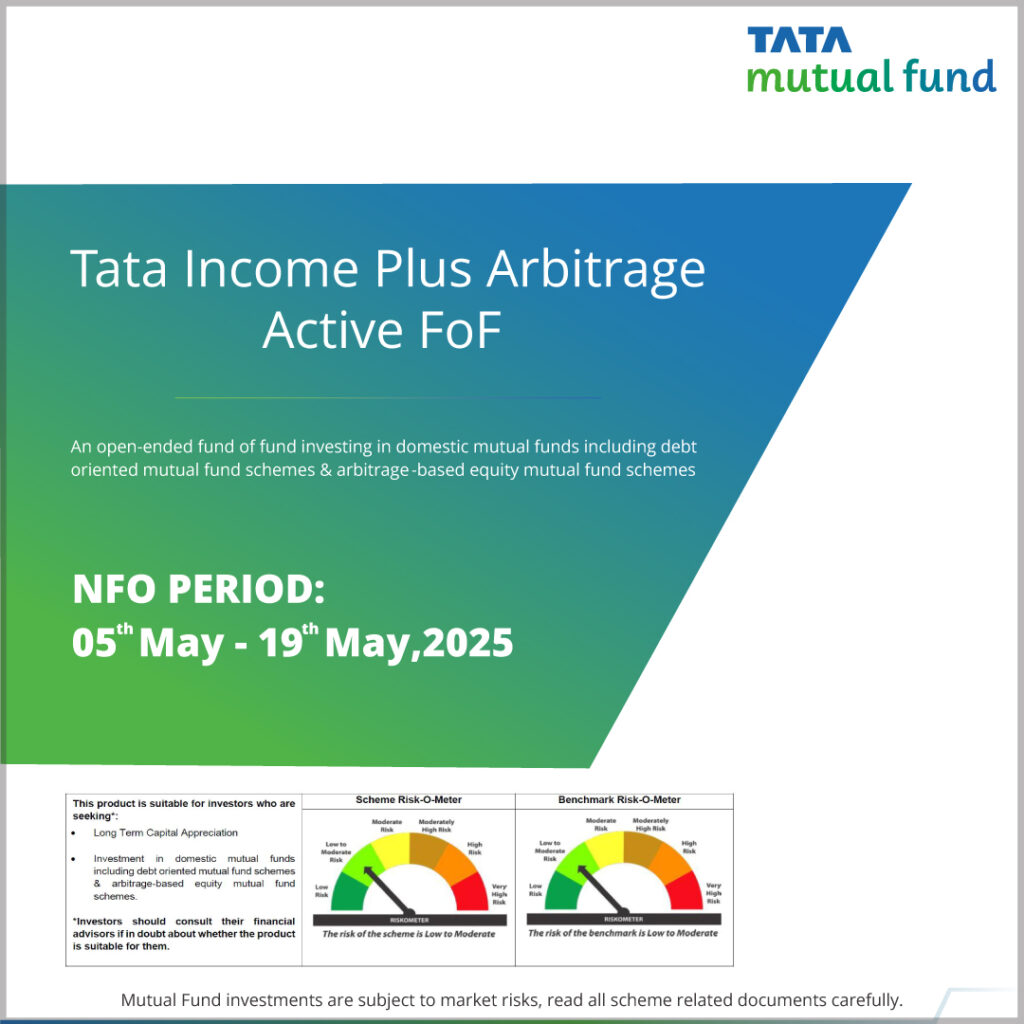

- Fund Type: Fund of Fund (Invests in Arbitrage Funds)

- Risk Level: Low to Moderate

- Ideal Investment Horizon: 3 months to 1 year (short-term)

- Tax Treatment: Treated as a debt fund for taxation (short-term capital gains taxed as per slab)

- Fund Manager: Industry experts from Tata Mutual Fund

Why Arbitrage Funds Appeal to Short-Term Investors

Arbitrage funds offer a unique combination of debt-like safety and equity-linked returns. They’re designed to generate returns through buying stocks in the cash market and simultaneously selling them in the futures market, pocketing the price difference.

Benefits include:

- Low Volatility: Limited exposure to directional equity risk

- Better Returns than Liquid/Ultra-Short-Term Debt Funds: Especially in bullish or sideways markets

- Tax Efficiency: Though FOFs are taxed like debt, arbitrage funds themselves are equity-oriented, which can be favorable depending on the investor’s profile

For investors parking funds for 3 to 12 months, arbitrage funds often outperform traditional savings or fixed deposits regarding post-tax returns.

Tata’s NFO Mutual Fund adds price

This offer of a new fund is not just another Arbitrage fund; It is a fund of funds, which provides exposure to several arbitrage strategies in the same product.

That’s how it is beneficial:

1. Diversification in mediation funds

Instead of putting your money into an arbitrage fund, this NFO has the diversity of reducing plan-specific risk and dependence on the strategy of a fund manager.

2. Active rehabilitation

The fund manager will dynamically distribute assets between different mediation schemes based on opportunities for arbitration, interest and market instability. This active perspective can lead to a better return on risk.

3. Operation

Since it invests in open arbitration funds, it maintains FOF-similarity, which is important for short-term investors.

Comparing With Other Offerings in the New NFO List

Tata Mutual Fund has recently been active in launching multiple new offerings, including the Tata Multicap Fund NFO aimed at long-term wealth creation. While that fund is more suited to long-term equity investors, the Income Arbitrage Active FOF is designed for a shorter investment horizon.

When comparing with other new fund offers:

- Equity-oriented NFOs like multicap funds are high-risk, high-reward

- Debt NFOs may offer safety but lack the upside of arbitrage funds

- Hybrid NFOs offer a mix, but not the same tax or return potential in the short term

That makes the TATA Income Arbitrage Active FOF one of the best NFO mutual fund options right now for short-term conservative investors looking for slightly higher returns than traditional savings options.

Who Should Invest in This NFO Mutual Fund?

This fund is suitable for:

- Short-Term Investors: Looking for a parking space for 3–12 months.

- Risk-Averse Individuals: Who want better returns than fixed deposits with limited equity exposure.

- Tax-Conscious Investors: Who understand the debt-taxation angle and can plan accordingly.

- First-Time Investors: Who want to start investing with low risk.

Who Should Avoid It?

While this fund offers low-risk returns, it may not be ideal for:

- Aggressive Investors: Seeking high returns or long-term capital appreciation

- Those Expecting Guaranteed Returns: Arbitrage is not a fixed return instrument

Ultra-Short-Term Investors (<1 month): Better off with liquid funds or fixed deposits

Tax Implications to Keep in Mind

Unlike pure arbitrage funds, which are taxed like equity funds, this fund of fund is treated as a debt fund for tax purposes:

- STCG (<3 years): Taxed as per your income slab

- LTCG (>3 years): 20% with indexation

This may make a difference depending on your holding period and tax bracket.

Should You Invest in This New Fund Offer?

If you’re a conservative investor looking to optimize idle cash or earn slightly better returns than your savings account without taking significant equity risk, TATA Income Arbitrage Active FOF is definitely worth considering.

Its diversified exposure to arbitrage strategies, active rebalancing, and relatively low-risk profile make it a unique new fund offer in the current market.

However, as always, it’s important to:

- Assess your investment horizon

- Understand tax implications

- Compare with other upcoming NFOs and existing options.

Conclusion

The mutual fund industry continues to innovate, and products like the TATA Income Arbitrage Active FOF highlight this trend. While it’s not a product for aggressive or long-term investors, it fits beautifully for short-term goals like:

- Parking emergency funds

- Saving for a wedding or vacation

- Bridging funds between major life events

With its low-volatility approach and diversified arbitrage strategy, it offers an attractive risk-reward balance.

As always, consult with a financial advisor or distributor before investing and keep an eye on the new NFO list to stay updated with launches that suit your profile. Ready to explore this New Fund Offer?

Check the NFO subscription period, SID (Scheme Information Document), and KYC requirements to invest easily through trusted mutual fund platforms or apps. The path to financial stability begins with smart choices and expert support. With Nivesh by your side, you can plan your short-term goals with confidence. Invest in the TATA Income Arbitrage Active FOF through Nivesh—an ideal option for low-risk, stable returns. Take the first step today and make your money work smarter. Your short-term financial success starts now!